The 3 Ways Today’s Auto Dealers Should Reinvent their Digital Future

After taking in the results to Cox Automotive’s annual 2022 Car Buyer Journey Study, it was clear that the impacts of digitalization were not only being felt by today’s consumers, but should ring a loud sounding bell for dealerships and OEMs alike to reexamine and reinvent how they do business online.

Some of the results from the over 10,000 auto shoppers surveyed were a surprise, while others were something our industry had predicted to see continue to trend. But whether a surprise or a given, the undercurrent sentiment of today’s consumers’ wants, needs and preferences all pointed to 3 specifics things.

Together, let’s take a different look at your business and marketing plans, and consider the 3 ways successful auto dealers are reshaping their current and future digital strategies to stay profitable and stand out to their ideal customer as the one to do business with.

#1: Online research – An opportunity to capture and recapture

With inventory shortages being a headline last year in our industry, it probably isn’t a surprise that auto shoppers had to spend more time online researching when it came to purchasing their car.

Thankfully, inventory challenges have started to ease, but we’re still seeing fluctuations. Some dealerships still have little to no inventory, while on the other hand others with a flip of a switch suddenly had a full lot at the end of last year. And still, many dealers are struggling to keep a consistent inventory of cars that have the packages and features their consumers actually want.

One other important thing to note is that the number of vehicles available, especially new vehicles, is still much lower compared to this time just a few years ago. For that reason, cross-shopping activity has grown within the last year and brand defection is happening at heightened rates.

This presents an opportunity to gain and stand out to new customers, especially if competitors aren’t putting the needed focus and investment into retaining their customers.

64% of buyers considered both new and used vehicles, which is up significantly from 55% in 2021

Today’s auto shopping experience has become less about finding the perfect vehicle, and more about finding any vehicle that ticks some of the boxes and fits within a consumer’s budget with increased interest rates and reduced manufacturer incentives.

It’s time to reset your CRM

Seeing that consumers showed less loyalty to dealerships and brands in 2022, especially new vehicle buyers, moving forward this will be an important segment of car buyers dealers should focus on and win-back. Staying alongside and in-front of them will take on an even more important role at the dealership over the next few years.

Traditional cadence vs. Needed cadence: Take the time within your CRM system to really look at what cadence and automations you currently have set up. Timelines have shifted due to inventory fluctuations, interest rates and doing more of the deal online – so the old ways of mapping things out in 7 day, 10 day, 30 day, 60 day, 90 day and so on may no longer be relevant.

You’ll have to set different timelines and different funnels depending on the shopper’s or previous customer’s situation, and you should be fast-tracking and educating the ones that are actively communicating with you what the possibilities are.

Lease Customers: In your CRM, don’t just rely on the OEMs automated lease notifications to your customers. It’s important to elevate your spotlight on these customers. They might need a different interval and set of communications based on if your brand isn’t really offering attractive lease incentives or if you know that you’ll probably still be facing some inventory challenges when that customer comes off lease. Remember, many lease customers were originally captured due to the attractive pricing, or having a new car every few years that is worry free.

Activate your CRM by reaching out to them well ahead of the normal curve, say 9 months before, educating them on the situation now, what they’d most likely face, and remind them of the advantages your brand and dealership offers. That way if they’d like to stay in a lease – great! You can pre-order a car or ensure one will be available for them. Or… if they want to buy but need help planning for financing options – you can help facilitate and ensure you keep them as a lifetime value client.

Remember – there is extreme financial value in lifetime value clients, and you don’t want to lose their loyalty or have them cross-shopping if you can be proactive with your CRM and stay alongside and in front of those clients.

Content influences vehicle choice

Let’s face it, customers are less likely to find their first-choice vehicle, so they do have to look for alternatives. With more cross-shopping, consumers are more reliant on content to help influence their vehicle selection.

69% of new car buyers who changed their mind during shopping cited content as the most important factor for learning about other brands and vehicles

For example, a Honda loyalist may be searching for a Honda Accord. If Honda currently has a lean inventory level, a Honda loyalist may have to cross-shop. Let’s say online content appears for a Hyundai Sonata during their research. They would have to gain more familiarity of the other brand, make and model, and determine if a Sonata is the right choice.

This is why content is crucial to cross shopping. You should be frequently evaluating not just how you show up to your current customers or consumers that already know about your brand, but also the frequency and way you show up to your competitors’ customers. Make sure you know the wants, needs and preferences of today’s auto shoppers, and tailor your content accordingly.

Videos: There have been significant shifts over the last 2 years. And it’s not surprising to see online videos move up in the rankings, now in the top 3. In particular, we found online test drive videos from an expert to be significantly more influential. Content like a test drive video allows consumers to engage in immersive digital experiences, especially as the purchase process moves more online.

Testimonials: Consumer ratings and reviews remain at the top of the list as well. Gen Z and Millennial buyers like to see and hear what others think, and let that help shape their interest and opinion. Remember, in an “Amazon” world we’re used to leaning on what another consumer experiences after the purchase, and you should be frequently highlighting this is your digital content.

#2 – Car shoppers prefer online purchasing – have options

In today’s digital world, it also probably doesn’t come as a shock that there is continued growth in consumer preference for completing most, or all, of the auto purchase experience online with the dealer or retailer.

68% Say they will do most or all

of their vehicle purchase process online in the future

80% Think it’s a good or great idea

to buy entirely online

Where they are vs. where they want to be: Today, shoppers continue to show enthusiasm towards doing more parts of their shopping journey online, and they are still indicating that they want to do even more online in the future.

68% of shoppers say they would do most, or all of their purchase process online in the future, which is higher than ever before. But even more important to note is that 4-in-5 consumers think it’s a good or great idea to buy entirely online. It’s time for you, as well as our industry, to prepare to meet consumers where they are today and where they plan to be in the future, which is online.

Look at what digital retailing capabilities you have today and map out which ones you will need to adopt over the next few years. And remember, just because you build a “Field of Dreams” does not mean the consumer will just naturally come. You have to make sure that your marketing strategy includes educating and demonstrating to the consumer you have the capabilities they want and are willing to show them how to use them.

Highlight the benefits of online car shopping: The good news is that transacting digitally is a win-win for both consumers and dealers. The benefits recognized by consumers are largely time spent on a whole purchasing a car and pricing.

But it’s important to remember that although consumers recognize time saved at the dealership and overall efficiency as the top benefits of digital retailing, it’s still a newer process for them. Buying a $25 item online is quite different than buying a $40,000 car in their mind.

So be sure to highlight that the differences aren’t as big as they think and that purchasing a vehicle online has the same benefits they’re looking for in their other digital interactions: seamlessness, less friction, saving time and better price transparency.

A better car- buying experience and higher customer satisfaction: Digital retailing can and should lead to a better buying experience overall for the consumer, and you should be making sure your customer knows this with your marketing strategy as well as in-store experience.

A recent Cox Automotive study compared “Mostly Digital” buyers (those who did at least 50% of their purchase process online) to “Light Digital” buyers (those who did 20% or less of their purchase process online). The results found that “Mostly Digital” buyers are more likely to be satisfied with price, time spent, and overall experience.

Most importantly, it uncovered that “Mostly Digital” buyers tend to be more loyal to the dealership and brand. So make sure that your strategy includes options and optimizations for these customers as the segment will only continue to grow.

Bridging the online experience into an in-person dealership experience should not only include a strategy, but at this point be a consistent pillar of focus on how you do business. Make sure the experience online seamlessly blends into that same amazing experience they get in-person, and that they everyone is able to pick-up the deal wherever it was left online.

#3 – Connect and reimagine your dealership’s digital retailing capabilities

Consumers recognize the benefits of digital retailing… and it’s safe to say that dealers do too.

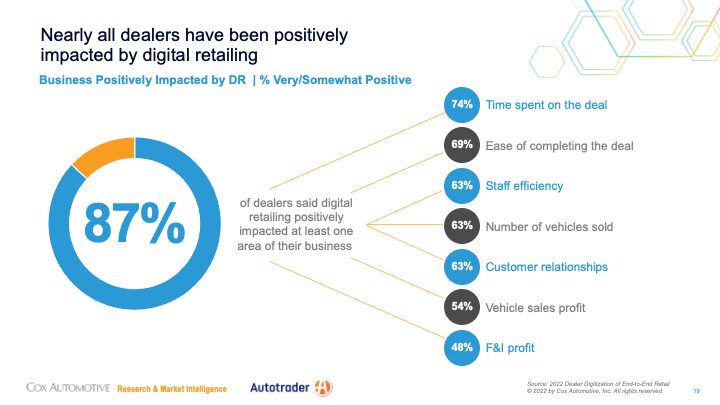

In the annual Car Buyer Journey study, we asked dealers what they’ve been doing with their digital retailing solutions since 2020, Many of them remain happy with their investments, with 87% saying that digital retailing has had a positive impact in at least one area of their business – time, ease and efficiency being the top areas, but also sales, profit and their relationships with their customers.

A closer look and self-audit: All dealers evaluate how they would rank the top reported positive impacts listed on the graphic above, especially noting the consumer and dealer advantages of: time spent on deal, ease of completing the deal, staff efficiency, and customer relationships.

If you were to have your new sales staff, or some of the other newer staff, run a 360-degree audit for you going through all the steps of the online purchase your dealership offers using what digital retailing tools you have, how would they report back to you on time spent, ease, efficiency, and the relationship / experience on a whole?

How to audit your dealership’s online car-buying process:

- Have your sales staff initiate a purchase process and time how long it takes from beginning to end.

- Ask them to note what was hard to do, and what was easy to do online.

- Make sure to ask them to be aware if they were retargeted at all when visiting other sites, if you have those capabilities enabled.

- Have them test the ease or uncover any bottlenecks you might not be aware exist during the end-to-end purchase process: research, discovery, scheduling a test drive, financing, etc.

- Ask them to do part of it online and see if one of your existing sales staff knew exactly where to pick up in-store – rate congruency and if the experiences matched.

- Remember, the advantage of having newer employees complete this audit is they still have a bit of a zoomed-out lens and will spot things that the older staff are just “used to” as a way of doing business. Lean on them to give suggestions and offer examples that work on other sites.

By consistently doing this 360-degree online audit monthly, or quarterly, and looking at your competitors in these same categories, you’ll have a proactive strategy to capture more of your ideal customers’ attention online. You’ll also be able to funnel them faster through the deal increasing satisfaction and improving your odds of gaining or retaining the sale.

Additionally, you’ll be able to form a blueprint of the capabilities of your current online digital retailing tools and strategize the tools you’ll need to add in order to provide the full eCommerce experience in the future. According to our research, when it comes to deal-making capabilities, consumers have high expectations of what they can accomplish on dealer websites in terms of digital retailing milestones. So make sure yours are mapped out and easy to find.

Know what your customer wants, needs and prefers digitally: In today’s times, you need to know your customer, know your business, know the experience you offer your customer, and make sure that your digital retailing tools are working for you!

This should be aligned with your business and regional goals. For example, a dealership in rural Iowa will have different consumers than that of Laguna Beach, California. Take a deeper look at what your customers and consumers want when it comes to an omnichannel and an ecommerce experience. Then make sure you build and work around what their preferences are today, as well as plan to build it for the future when it comes to your digital retailing and online capabilities.

- New car pre-order: Dealers and OEMs should also be focused on a consumer’s interest in, and increasing appetite for, new car pre-order. By reevaluating how your brand and dealership not only handle it but promote and educate around it online during the entire car buyer journey, you can reinvent your marketing strategy to include this growing capability and demand.

With today’s continued fluctuating inventory, coupled with the rise in consumers saying they want to and are willing to complete new car pre-order now, and in the future, it should be a larger focus of your online and digital retailing strategy for years to come. But remember, this is still “new” to many consumers, and you must educate and assure them of the benefits, as well as show them how it’s successfully done online.

For the road forward

By understanding what today’s car shoppers’ wants, needs and prefers are, you’ll be able to strategize and capitalize on the digital opportunity for growth. It’s time for dealerships to re-examine their marketing and business strategy to connect and extend their capabilities to attract in-market auto shoppers as well as retain their existing customers.

By implementing the 3 ways listed above into your strategy, you will not only have reimagined a more profitable way to run and operate your business, but you will be aligned with where consumers are headed currently and in the future.

Autotrader provides you with qualified leads for people that want cars. We have the data, and we have the shoppers. We know what they want, and our goal is to match them with our dealer partners, driving quality leads and delivering a 35% higher gross profit on average. We connect you with customers virtually, to move shoppers to you, so that you can focus on building and letting your brand shine.

Cox Automotive has the most connected and comprehensive view of the automotive industry and offers unmatched data and insights into consumer behavior, automotive trends, and operational best practices. Whatever your goals, we can help you get there faster and to stay a step ahead and successful in today’s marketplace.

Want to hear all the insights from the Car Buyer Journey Study? Catch the replay of the Automotive News webinar held by one of Cox Automotive’s senior researchers Vanessa Ton, where she shares examples of what actions you should take now, and outlines strategies successful dealers and OEMs are implementing in order to overcome those challenges the study revealed. On-demand replay: Insights from Over 10,000 Auto Shoppers: The 4 Ways Dealers Should Shift Their Marketing Strategy in 2023